Based in Belfast, Northern Ireland

Ewan Boyle

Director

Ewan has been operating in the Financial Services Sector for over 30 years. He is responsible for the Regulatory Functions within the Northern Ireland business, as well as overseeing the future strategic direction of the organisation. He is passionate about the business retaining its core values as well as fulfilling its vision of being both the adviser and employer of choice, in the Northern Ireland space.

Ewan is a season ticket holder with Ulster Rugby Club. Sailing is another passion, which means you will often find him out on the water near Strangford Lough attempting to win races. He is actively involved in a number of charities and tries to use what he has been given to help others in any way he can.

Find out more about Ewan and our Belfast team...

Nothing found.

Home › Amber River NI › Ewan Boyle

Ewan Boyle

Director, Amber River NI

Ewan is a season ticket holder with Ulster Rugby Club. Sailing is another passion, which means you will often find him out on the water near Strangford Lough attempting to win races. He is actively involved in a number of charities and tries to use what he has been given to help others in any way he can.

Talk to our Amber River NI team today

Articles related to Ewan and his team

13 October 2022

What are your options when a business partner dies?

How can you prepare for the death of a business partner? We look at the key questions and planning options business owners should consider

13 October 2022

Is critical illness cover worth the cost?

A serious illness or disability can have a huge impact on your finances - critical illness insurance will provide much-needed financial support

23 April 2022

The four key stages of financial business planning

Kerry McCaughan looks at four critical stages of family financial business planning: protection, profit, succession and inheritance

28 March 2022

Supercharge your pension tax relief like a superhero

Are you making full use of the tax relief allowance on your pension? If not, you could be losing out on thousands of pounds towards your retirement

Find out more about Ewan and our Northern Ireland team

Our Belfast team has been offering financial planning advice to clients across Northern Ireland for over 40 years. The business was one of the first to join the Amber River group in 2019, and has since expanded to incorporate Belfast firms Barr & Law and White McMullan Barnes, alongside a new office in Coleraine.

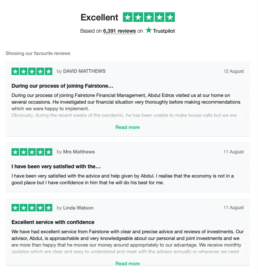

What our clients say

Ruth Anne Morant, Belfast

Amber River NI has been managing my finances for almost 32 years. The company has grown considerably in that time, however the attention and advice which I receive is still as excellent as it was. I have no hesitation in recommending their services.

Amber River NI has been managing my finances for almost 32 years. The company has grown considerably in that time, however the attention and advice which I receive is still as excellent as it was. I have no hesitation in recommending their services.Ruth Anne Morant, Belfast

Book an introductory call with one of our planners to chat through what’s important to you